7 VA Loan Tips for Idaho Veterans

Table of Content

Nicknamed the Gem State because of the abundance of gemstones found in it, Idaho provides open space for people seeking a more remote lifestyle. Despite the fact that it is landlocked, it does have ample rivers that allow it to be an inland seaport. The gross state product for 2012 was $59 billion, and the per capita income is $36,472. The economy is largely rooted in food processing, lumber, wood products, machinery, chemical products, and paper products. The largest sector in the state is Science and technology which accounts for over 25 percent of the states revenue and 70 percent of the states exports.

The VA does not have a minimum credit score requirement. Some banks/lenders may impose a credit score requirement on top of the VA credit guidelines. Benchmark Mortgage follows the VA requirements only requiring extra “compensating factors” for low credit scores. Savings, if any, vary based on consumer’s credit profile, interest rate availability, and other factors. Before approving a VA mortgage, the Department of Veterans Affairs will usually need to ensure that risk is minimized.

Nampa, Idaho

Your spouse was rated disabled and was eligible for disability compensation at the time of death. Before you buy, be sure to read the VA Home Loan Buyer's Guide. This guide can help you under the homebuying process and how to make the most of your VA loan benefit.Download the Buyer's Guide here. In addition to his experience in the business world, Devin proudly spent seven years serving in the Marine Corps. His military experience has provided him discipline and a strong work ethic that he has applied in every aspect of his life. VA Home Loan Centers is an approved originator of VA mortgages.

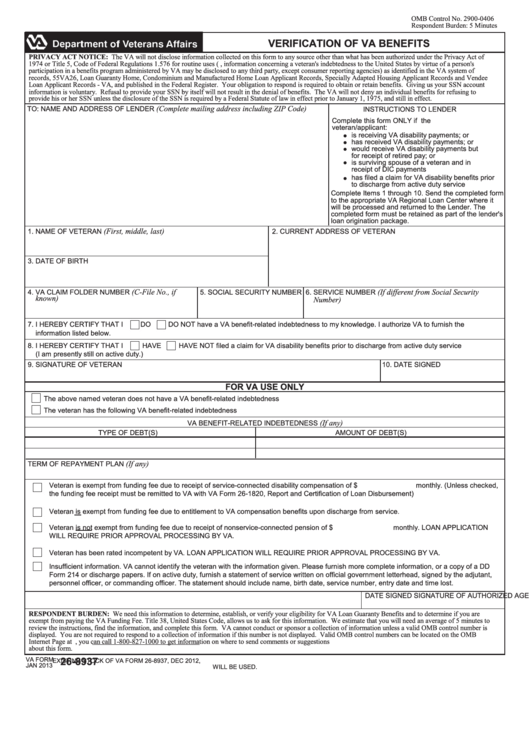

Contact your VA regional loan center and ask if they can recommend an experienced agent in your area that is well-versed VA loans. Department of Veteran Affairs and is proof that you are eligible for the VA home loan benefit. To check your eligibility, first obtain your DD Form 214. A VA-approved lender can then request your VA Certificate of Eligibility for you or you have the option to request it directly from VA’s eBenefits website. Not affiliated with Dept. of Veterans Affairs or any government agency. VALoans.com is not affiliated with or endorsed by the Department of Veterans Affairs or any government agency.

National Observances

Your local Finance of America advisor Devin Fahrner will provide you with extensive knowledge on mortgage products and loan options, all while creating a personalized mortgage solution that works for you. Unlike VA mortgages, which are backed by the Department of Veterans Affairs, VA small business loans are partially guaranteed by the Small Business Administration. The SBA is a government agency with the purpose of driving entrepreneurship and fostering the development of small businesses. According to SBA.gov, veteran-owned businesses represent one of the fastest growing segments of the economy.

It should be noted that while Idaho veterans can take advantage of the above perks, putting as much money possible into your down payment is strongly suggested. The more you can pay upfront, the faster you will be able to pay off your home in the long run. It is important to be honest as to how much you can afford and develop a feasible budget for you and your family. At Diversified Mortgage Group we have over 25 years experience in the lending industry. So rest assured if you are working with us we will make the VA home buying process easy on you. No expensive monthly Private Mortgage Insurance required on most conventional and the FHA loans with less than a 20% down payment.

What do I need to apply for an Idaho VA Loan?

Even though VA loans are more popular now than ever before, it is still different than a traditional loan and should be treated as such. Here are 7 VA Loan tips to consider if you’re thinking of buying a home through a VA loan. Diversified Mortgage Group will order a VA appraisal/inspection. The VA appraiser does a more complete evaluation of the residential property than with typical financing. The reason for doing this is not just to determine that the home is worth the price the seller is asking, but additionally to ensure that there are no problems with the building.

If you’re experiencing financial hardship due to the COVID-19 emergency, you can request a temporary delay in mortgage payments. Our aim is to make the VA loan process as simple as possible. We are here to guide our clients every step of the way because we understand how valuable our customer's time is. As our customers, we put your priorities first and want there to be complete transparency throughout the VA loan process. To help with this, listed below is some information to answer your FAQs and get you started. Devin Fahrner has over two decades of experience in the mortgage and consumer finance industries and uses his knowledge to provide the highest quality services to his clients and their families.

VA Loan Tips for Idaho Veterans

There are numerous advantages to buying a house through a VA loan. Some of the major perks include a $0 down payment on your mortgage, the option to forgo private mortgage insurance , lower interest rates, and lower closing costs. A Veterans Affairs loan is a mortgage loan that is specifically designed for military personnel, veterans and military families. Department of Veterans Affairs and is a home mortgage loan issued by approved lenders, such as Devin Fahrner, and is guaranteed by the federal government.

These letters provide documented proof of the applicant's history of service and whether they are entitled to a VA loan. You are still responsible for certain closing costs (i.e. application fees, insurance, inspection fees, real estate taxes, and more). Additionally, the VA does not set a minimum credit score needed for a VA mortgage loan. However, having fantastic credit can help to attain a rock bottom variable or fixed interest rates. To know where you stand, be sure to continually check your credit report to develop better credit practices. Serving in the US armed forces is easily one of the most respectable professions many men and women can have.

VA Home Loans are provided by private lenders, such as banks and mortgage companies. VA guarantees a portion of the loan, enabling the lender to provide you with more favorable terms. The VA Loan program allows qualified, current homeowners to take advantage of lower rates in order to have an overall lower monthly payment. If you are in need of home improvement or some extra help paying off auxiliary debts, a VA refinancing can help you obtain the funds you need, when you need them. Many thanks to Shannon O'Keefe from Money.com for writing this educational and informative article for our many valued Idaho veterans. For more information and further resources, please refer to this guide to the8 Best VA Loan Lenders as of November 2022where you'll find helpful research to help you get the most out of your military benefits.

Depending on the applicant's service history and current status, the conditions for providing proof of service can vary. VA loans offer affordable homebuying options for active service members, military veterans and their families. Provided by the United States Department of Veterans Affairs, these mortgages offer advantages that ease the financial burden on prospective homebuyers. When a veteran purchases a home using a VA loan in Idaho, a termite inspection is not required. The property tax exemption is available to veterans who suffered a service-related injury that has left them with a disability rating of 10 percent.

This agency has its own Office of Veterans Business Development, which takes in applications and helps back loans provided by third-party lenders. No, since VA loans are backed and guaranteed by the US government, private mortgage insurance is not required. This, in addition to zero down payments and lower interest, Could save VA loan borrowers throughout the mortgage's term. Certificates of eligibility allow applicants to demonstrate their history of military service to a lender. COE's can be obtained by veterans, active members of the military or national guard and families of service members.

It has no affiliation with the US Department of Housing and Urban Development, the US Department of Veterans Affairs, the US Department of Agriculture or any other government agency. You can obtain a VA loan for a manufactured or modular home with Guaranteed Rate in all states, single-wide manufactured homes and leasehold properties not included. Like all VA loans, you need a Certificate of Eligibility and proof of service. The truth is I have seen many horrifying practices in real estate both on the lending and real estate side.

Comments

Post a Comment